The path of interest rates in 2024

What a painful two years of sharp interest rate rises it has been following the heady decade that followed the global financial crisis, when central bankers kept monetary policy remarkably loose. Thankfully for now, inflation has been steadily falling across the globe, and rates seemed to have peaked.

But it’s not quite time to break out the bubbly just yet. The potential for sudden inflationary shocks are likely to keep interest rates elevated for the time being. With developed market rates currently sitting at around 5% though - is this the level we should get comfortable with, or will they go lower? If so, when?

An evolving landscape

The globe is morphing in a myriad of ways that could be inflationary.

Economies are decoupling as they attempt to ‘re-shore’ and ‘near-shore’ their supply chains and produce goods closer to home. Workers remain in short supply as increasing numbers tip into retirement. Governments are slated to spend trillions decarbonising the planet. And of course, there’s the feisty geopolitical situation: where not only are democracies facing the biggest ever election year on record, but brewing tensions and the potential for conflicts and rising trade barriers may disrupt supply chains.

All of this points to a Whac-A-Mole future where inflation rears its ugly head in unpredictable ways and central bankers must remain alert: interest rate mallet firmly in hand. This need for vigilance against inflation may result in interest rates settling higher – popularised as ‘higher-for-longer’ - than the near-zero levels of the decade following the global financial crisis.

For the time being, however, inflation seems to be falling, and central bankers have eased-off tightening the interest rate ratchets any further. But with many of us feeling the squeeze from expensive bills, how soon can we expect actual falls in interest rates?

A mishmash of paths

Economies around the world are emerging from the cost-of-living crisis out of sync, with their rates of economic growth and inflation moving in different directions and speeds – key factors in monetary policy decision-making. As such, the global interest rate journey is likely to be varied and tricky to predict.

The US economy appears strongest among developed economies and set for what economists refer to as a ‘soft landing’ - avoiding a cyclical recession. Slowing inflation seems to be taking hold and rates seem likely to have peaked –which, in its latest December meeting, the Fed has said it expects to start cutting this year.

Yet, with US growth proving resilient, rising 2.4% in 20231, Fed policymakers may remain cautious about cutting rates – which risks squeezing the economy into a minor recession.

Europe’s economic challenges seem greater, with growth slowing in 2023 by varying degrees, and Germany and the UK looking especially weak.

In this environment, inflation has fallen relatively quickly, and with growth continuing to look weak in both the Euro area and the UK, the European Central Bank (ECB) and the Bank of England may be tempted to cut this year to offer their economies a little boost.

Further afield, Japan seems likely to buck the trend among major advanced economies by tightening the monetary levers as inflation shows signs of finally taking hold – long sought in a stagnant economy that has battled deflation for more than 25 years.

Elsewhere, in emerging markets, many of the early hikers such as Brazil, Chile, Hungary, Mexico, Peru and Poland are seeing a sharp drop in inflation and are either cutting – or close to cutting – interest rates.2

Then of course there’s China, whose reopening was key for global growth in 2023 but light has faded given the issues it faces in the property sector and with an ageing population. Having loosened the monetary levers a little in 2023, it may opt for more action to support growth.

What levels are we talking?

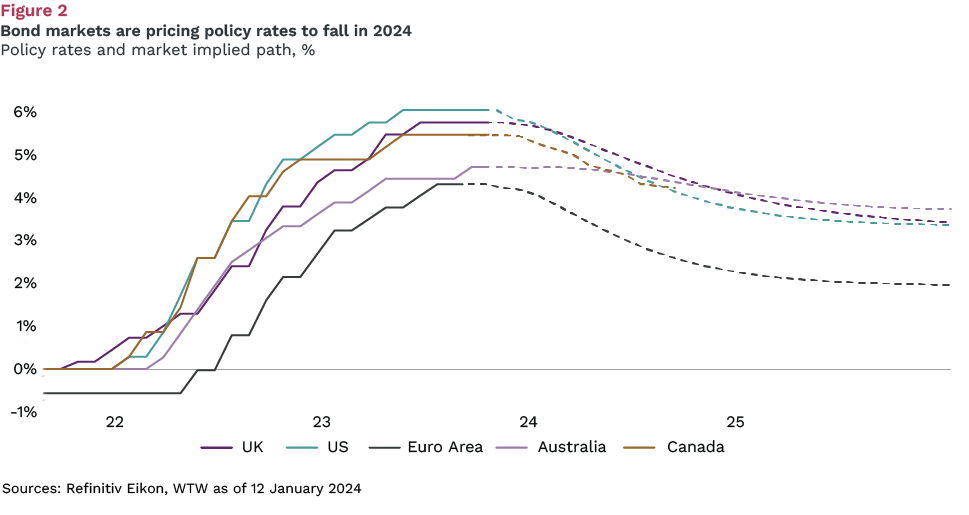

The bond markets offer some clues as to the pathway for interest rates. They project that, though cuts are on the table this year, they’re unlikely to drop precipitously:

That said, we must consider that bond markets have themselves proved unreliable at forecasting in recent years, and any number of external shocks could derail central banker sentiment - whose sleepless nights are fed by fears of rousing the inflationary dragon.

Nevertheless, markets are telling us that, even if rates are cut, the natural rate of inflation that keeps economies in check is likely to remain elevated. This implies challenging financing conditions for businesses, especially if they rely heavily on debt, and may serve to put the brakes on economic growth - making for a fragile economic outlook in the near term.

Investing in this environment

Times where macroeconomic forces bear down strongly on economies creates a tricky investing environment – there’s much for businesses to navigate, and the dispersion between winners and losers is likely to grow into a yawning chasm. What’s more, with generative AI having had a breakout year in 2023, in 2024 we may see the impact of the nascent technology filtering down into different industries and beginning to change the playing field.

As such, for investors, it seems now is the time for globally diversified portfolios, such as Alliance Trust, whose professional stock-pickers are able to analyse the onslaught of complex factors affecting the trajectory of economies and businesses, and invest in the best investment opportunities across countries and sectors

Companies mentioned are for informational purposes only and should not be considered investment advice.

Marcus de Silva is a Freelance Investment Writer.

1. WTW Global Outlook – Macro and Strategy 2024

2. Goldman Sachs, Asset Management Outlook 2024

This information is for informational purposes only and should not be considered investment advice. Past performance is not a reliable indicator of future returns. The views expressed are the opinion of Towers Watson Investment Management (TWIM), the authorised Alternative Investment Fund Manager of Alliance Trust PLC, and are not intended as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell any securities. The views expressed were current as of January 2024 and are subject to change. Past performance is not indicative of future results. A company’s fundamentals or earnings growth is no guarantee that its share price will increase. You should not assume that any investment is or will be profitable. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

TWIM is authorised and regulated by the Financial Conduct Authority. Alliance Trust PLC is listed on the London Stock Exchange and is registered in Scotland No SC1731. Registered office: River Court, 5 West Victoria Dock Road, Dundee DD1 3JT. Alliance Trust PLC is not authorised and regulated by the Financial Conduct Authority and gives no financial or investment advice.